Is Your Pension Plan Fully Funded? Plan Your 2021 Retirement Contributions

Did you know that there are over twenty-four (24) types of pension plans? Part one of this post will discuss the 2021funding contributions for the most common plans: SIMPLE IRA, 401Ks, and IRAs. Part two of this post will discuss some of the more sophisticated tax planning that Moskowitz LLP provides, aiming to obtain tremendous tax savings, cash flow, investment growth, asset protection, and business advantages for our clients.

Pension Planning: Part One

As part of your planning for next year, now is the time to review your plan to maximize these great tax deductions, substantial other collateral benefits, and plan to fund your retirement accounts. By establishing your contribution amounts at the beginning of each year, the financial impact of saving for your future should be more manageable. Even the funding was given special benefits from Congress. Unlike almost every other deduction that needs to be paid by year one end, pensions do not. You have until the filing of the tax return including an extension in year two to fund the pension in year one, or about ¾ of the way into year two for a deduction enjoyed in year one. Another example of this preferential timing is that you can make multiple years contributions in one calendar year to offset an unusually prosperous year instead of paying the taxes.

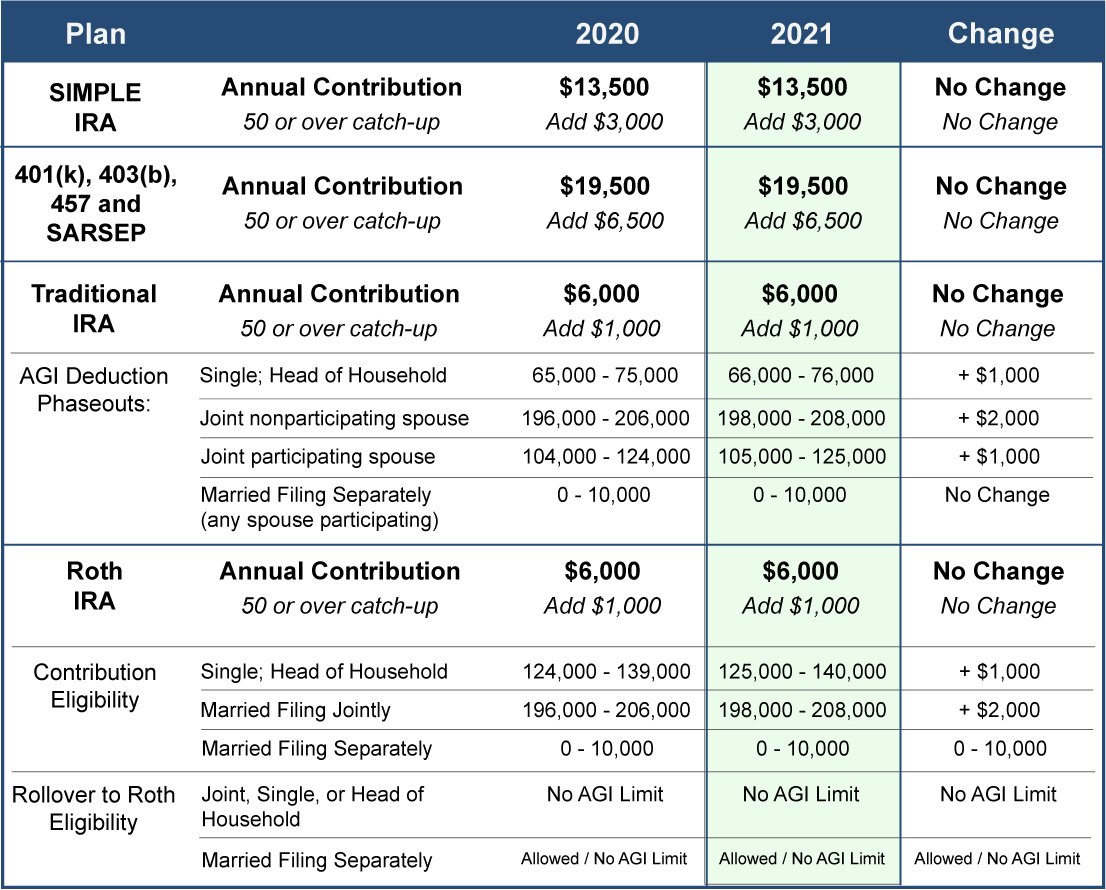

Here are annual contribution limits for the more popular programs:

What you need to do when it comes to retirement planning

- Identify the retirement savings plans that you currently have established. Please remember that you can have multiple pension plans at the same time.

- Consult with Moskowitz LLP regarding the plan you have in place and what options may be available. Note the annual savings limits of the plan for next year and adjust your savings to take full advantage of the annual contributions. Remember, a missed year is a missed opportunity that does not come back.

- If you are 50 years or older, add the catch-up amount to your potential savings total.

- Take note of the income limits within each plan type.

- If your income is below the noted threshold for traditional IRAs, your taxable income is reduced by your contributions. The deductibility of your contributions is also limited if your spouse has access to a plan.

- In the case of Roth IRAs, the income limits restrict who can participate in the plan.

Other retirement planning ideas to consider

If you have not already done so, also consider:

- Setting up new accounts for a spouse or dependent(s)

- Using this time as a chance to review the status of your retirement plan, including beneficiaries (this should also be considered in your annual estate plan review).

- Reviewing contributions to other tax-advantaged plans like Flexible Spending Accounts (health care and dependent care) and prepaid medical savings plans like Health Savings Accounts.

Pension Planning: Part Two

Are you a business owner or decision-maker that wants to lower your tax bill?

As part of its tax planning and business advisory services, Moskowitz LLP provides pension structure reviews and advice to allow you to reduce your current year’s taxes significantly. Coincidently, pension plans also have additional benefits such as asset protection, employee retention, and the ability to leverage cash flow. Where appropriate, we often recommend a combination of qualified plans, such as a 401K and a cash balance plan.

While many people are familiar with the 401K concept, you may not be familiar with a cash balance plan. While a cash balance pension plan is a defined-benefit plan, unlike the regular defined-benefit plan(think traditional pension), the cash balance plan is maintained on an individual account basis, much like a defined-contribution plan (such as an IRA).

As in a traditional pension plan, investments are managed professionally, and participants are promised a certain benefit at retirement. However, the benefits are stated in terms of a 401(k)-style account balance rather than the terms of a monthly income stream.

Having a cash balance pension plan, in addition to a 401(k), can allow older business owners to turbocharge their retirement savings because of the generous contribution limits that increase with age while lowering their income tax burden dramatically.

Moreover, the 2020 CARES ACT (Coronavirus Aid, Relief, and Economic Security Act) provides incentives for establishing these types of plans by providing tax credits for professional fees to implement and maintain plans.

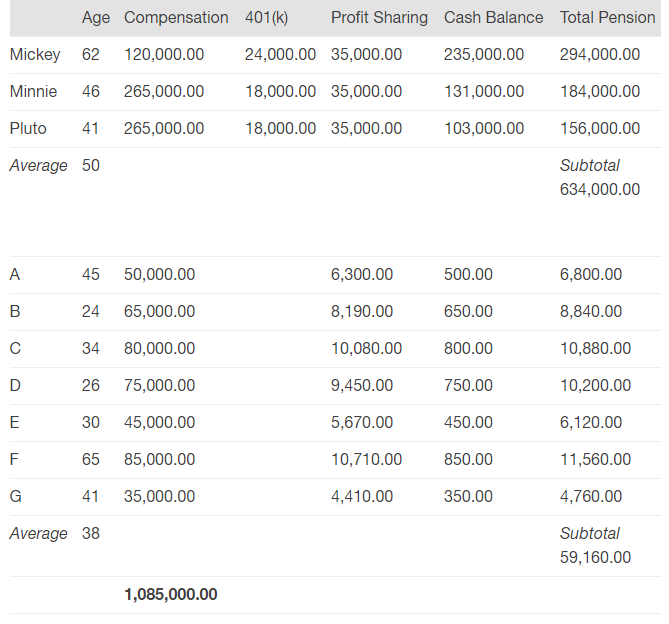

Defined benefits plans and cash balance plans offer great flexibility and tax savings potential. For instance, in this example, the owners, Micky, Minnie, and Pluto, can contribute substantial amounts while making nominal contributions to their employee’s plans (the employees have the option to contribute up to plan limits of their wages).

Combination Cash Balance and 401(k) Profit-Sharing Plan

Other examples of Moskowitz LLP pension structure and tax planning problems we solve:

Leveraging Real Estate Equity*:

Our client: Our clients are a successful construction company.

The tax problem: Who owns several buildings in San Francisco, Oakland, and Walnut Creek outright. The properties had been fully depreciated, and the principals wanted to lower their income tax burden.

Moskowitz LLP solution: Upon reviewing their pension plan, we were able to recommend that they consider refinancing some or all of their real estate now that interest rates are low and using the money to make large pension contributions.

The benefits:

- Tax-deductible contributions to the pension plan of over $200,000 per year. Many people and businesses are able to contribute substantially more. This money would grow tax-free until retirement.

- Create a tax-deductible mortgage payment for the company, which would dramatically reduce income tax.

- As with any non-covered claim against the company, substantial asset protection could reach equity in the real property.

Commercial Real Estate Investor*

Our client is an investor in an LLC who holds and invests in Silicon Valley commercial real estate.

The tax problem: Business is good, which results in significant capital gains.

Moskowitz LLP solution: We recommended that our client increase his salary from $100,000 to $250,000 to allow him to take advantage of retirement savings options in addition to raising his compensation to a more reasonable level. While this did raise his social security taxes by about $5,000, he installed a 401K plan and Cash Balance Plan. His 2020 contributions were: $222,000 to a cash balance plan, $26,000 to the 401K & $15,000 to the profit-sharing portion of the plan, and $22,500 in ROTH IRA contributions. This decreased his federal income tax by over $160,000. Over the next two years, he will save over $250,000 in taxes, AND when he retires (retiring outside of California), he will NOT have to pay a penny of California income tax on these funds even though he reduced his California income taxes by deducting his pension contributions.

Some 2021 Dates to Remember when it comes to Pensions:

January 4, 2021 – 2019 Pension Funding Deadline (extended by CARES Act)

February 1, 2021 – Deadline to distribute Form 1099R to participants and file Form 945 with the IRS to report income tax withheld

March 15, 2021 – Deadline to process corrective distributions for failed ADP/ACP tests without 10% excise tax for plans without an Automatic Contribution Arrangement.

March 15, 2021 – Partnership & S Corp tax returns due (can request an extension to file).

Moskowitz LLP is a tax law and accounting firm that has dedicated over 30 years to representing individuals and businesses with civil and criminal tax problems, cleaning up accounting and tax messes, and providing tax and accounting advisory services. We offer practical and affordable tax and accounting solutions.

Please contact us for a consultation today.

Remember a blog post or email blast is not a substitution for obtaining personal legal and tax consultation. This information is not intended to be legal or tax advice nor does it form an attorney-client relationship between us.

* Moskowitz LLP does not offer any guarantee of case results. Past success does not guarantee success in any new or future case. This case example does not provide all facts and does not constitute a guarantee, warranty, or prediction regarding the outcome of your legal matter.