The first international cryptocurrency transaction occurred in 2010. Laszlo Hanyecz of Florida posted on a Bitcoin forum that he would pay 10,000 Bitcoins to anyone willing to have two large Papa John’s pizzas delivered to his house. A man from London took Laszlo up on his offer and had two such pizzas delivered to his doorstep. The pizzas were worth $25, and 10,000 Bitcoins were $41 at the time. Even though Laszlo was overpaying in Bitcoin, he issued the “challenge” because he thought the whole cryptocurrency transaction idea was a very cool innovation.

As of June 2022, those 10,000 Bitcoins are worth over $300 million. What if Laszlo had kept the Bitcoin, and sold them last month? What would the capital gains taxes have been on that?

Determining Crypto Cost Basis

Since cryptocurrency is viewed by the IRS as property; it is subject to capital gains tax. In order to make this calculation, you have to know how much the crypto was worth when you initially put money into it. This “cost basis” is determined by how you came to acquire your digital funds:

- Crypto Purchase: Calculating the cost basis of a cryptocurrency purchase is simple:

[Fair market value of the cryptocurrency] + [purchase fees (e.g., brokerage, transaction fees)] = [cost basis]. So if you bought Bitcoin for $500 with a transaction fee of $5, your cost basis is $505. - Mining or Staking: If you mined crypto or were rewarded in crypto from staking, your cost basis is determined by the fair market value when you received the digital currency. For example, if you gained 0.049 BTC that was worth $1,000 at the time of receipt, $1,000 is your cost basis.

- Receipt of Gifts: The cost basis of cryptocurrency received as a gift is determined by the fair market value of the crypto when you receive it. For example, if your sister purchased $1,000 worth of crypto that was worth $1,200 on the day and exact time she gifted it to you – your cost basis is $1,200.

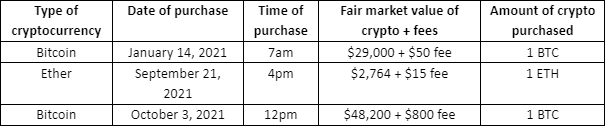

To determine capital gains (or losses) as accurately as possible, any instance of cryptocurrency entering your wallet must be documented. Here is an example of a Crypto investment chart:

Most exchange platforms document this data for you, but it’s always best to keep your own detailed records. Accurate documentation of your cost basis gives the IRS less incentive to audit you when you report your short-/long-term capital gains.

Is it a Gain or a Loss?

Before we get into how much you owe the IRS, you must realize the profits of your investment. Cryptocurrency profits are calculated as follows:

[Fair market value of crypto when “cashed-out”] – [cost basis] = [capital gain/loss]

This equation will have one of the following two outcomes:

- Negative Result: You’ve realized a capital loss. Losses can work to your advantage because you are entitled each year to declare up to $3,000 in losses to offset other gains you might have during the course of the year. After the deduction of the first $3,000, the remainder of your capital losses carries over to the following year, and if not used in its entirety, to the following years until the entire amount of the loss has been applied. This is another example of how good recordkeeping can save you money and unnecessary headaches.

- Positive Result: You’ve realized a capital gain. Your cryptocurrency investment was a success! Now it’s time for the IRS to tax it…

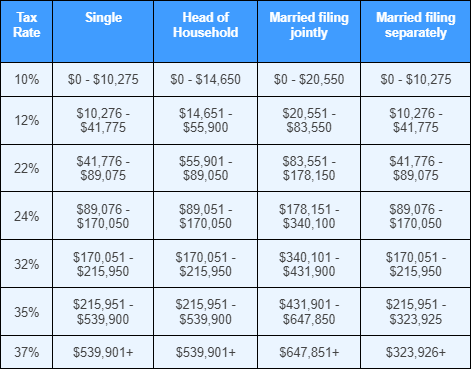

Short-Term Capital Gains

Short-term capital gains – whether they come from crypto or other investments – are taxed as regular income. As with all investments, capital gains taxes depend on your filing status and household income. If you hold your crypto for less than 366 days before withdrawing it, the following Federal Short-Term Capital Gains Tax Rates apply:

2022 Rates:

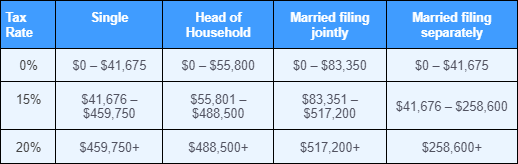

Long-Term Capital Gains

If you’ve held your crypto for 366 days or longer before withdrawing it, the following Federal Long-Term Capital Gains Tax Rates apply:

2022 Rates:

*Note that most states also tax capital gains (short-term and long-term) on the state level. This complication adds another variable into to the arduous equation that every US citizen must solve before submitting their taxes to the IRS.

Back to Papa John’s

Let’s get back to our original question: What if Laszlo had decided to call off the pizza deal and never paid the British guy the 10,000 Bitcoins?

Here’s the calculation:

Basis: Let’s just assume that Laszlo had purchased the Bitcoins when their fair market value was $41, and there were no transaction fees at the time. His cost basis in the Bitcoin would be $41 [FMV + fees].

Gain: On the day and time in June 2022 that he sold the Bitcoins, their value was $300,000,041. His gain would be $300,000,000 [FMV at sale – cost basis].

Tax Rate: Let’s say that Laszlo is a married man who files jointly with his wife, and that their joint annual income is $100,000. That puts them in the 15% long-term capital gains tax bracket.

Calculation: 15% of $300,000,000 = $45,000,000

Fortunately, he lives in Florida which doesn’t tax capital gains at a state level. If he lived in California, he would need to pay an additional 9.3% in state taxes.

Tax Attorneys for Crypto Investors

The best investments are the kind that make money and save you the largest profit possible. Contact us to learn more about how we can help you manage your cryptocurrency and minimize your tax liability.